ST Pro MAX

ST MA Cross Pro

The Ultimate Multi-MA Trading System with intelligent entry signals, dynamic stop management, and real-time P&L tracking. Features Pullback Opportunity (PBO) detection, multi-timeframe trend analysis, and a comprehensive dashboard for stocks, futures, and options.

🎯 Signal Detection

Choose from Single MA Cross, Two MA Cross, Single MA + VWAP, VWAP Only, Two MA + VWAP, or custom combinations. Each method automatically detects optimal entry points based on your selected moving averages and price action confirmations.

Intelligent detection of pullbacks to your trend MA for optimal re-entry points. The system identifies when price temporarily moves against the trend before resuming, giving you high-probability second chances with defined risk parameters.

Analyze MA alignment across 4 customizable timeframes simultaneously. Visual stack indicators show when all timeframes are in agreement, dramatically improving win rates by confirming trend direction across multiple time horizons.

🛡️ Risk Management

ATR-based stops, fixed-point stops, trailing stops, MA-based dynamic stops, percentage stops, and volatility-adjusted stops. Each system adapts to market conditions to protect your capital while maximizing profit potential.

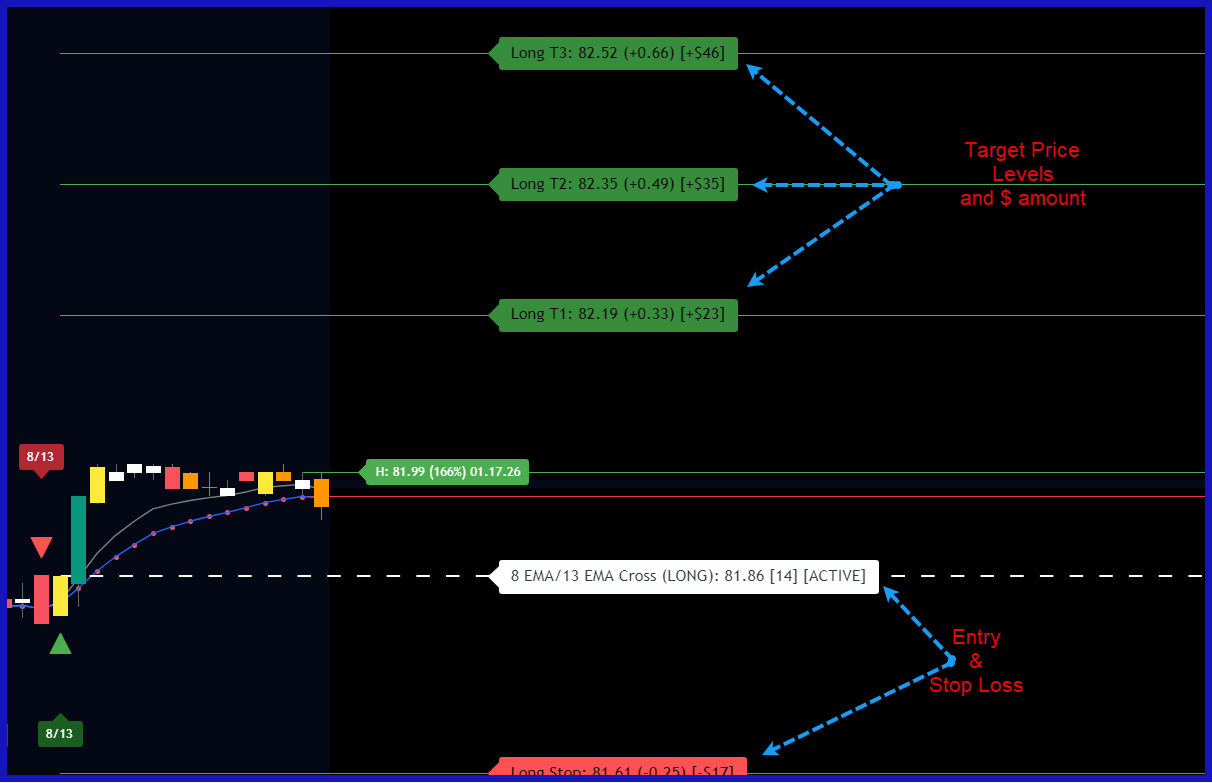

Real-time risk/reward ratios, dollar risk calculations, position P&L tracking, and distance-to-target monitoring. For options traders: live Greeks calculations, delta-adjusted targets, and premium change estimates at each level.

Auto-calculated T1, T2, and T3 targets using ATR multipliers or fixed points. Customizable target ratios (1:1, 2:1, 3:1+), automatic profit-taking levels, and visual tracking of target achievement with reset capabilities.

Configurable time limits ensure signals don't go stale

Visual trend confirmation with 21/50/200 EMA clouds

Entry signals, stop hits, target achievements, and more

Hello, World!

ST Pro HVC High Volume Candles

ST Pro High Volume Candle

The Ultimate Volume Detection System that identifies institutional activity, breakout confirmations, and key price levels through intelligent candle coloring and multi-level volume analysis. Spot smart money moves before they become obvious with visual OHLC markers and customizable alert zones.

📊 Volume Intelligence

Automatically categorize candles into Level 1 (140%), Level 2 (200%), and Level 3 (300%) based on volume relative to moving average. Each level uses distinct color intensities to instantly identify the strength of institutional activity. Customize thresholds from 100% to 1000% to match your trading style and market conditions.

Automatic color overlay distinguishes bullish vs bearish high-volume candles with gradient intensities. Green shades for buying pressure, red shades for selling pressure. Light colors for Level 1, medium for Level 2, dark for Level 3. Instantly spot where big money is flowing without cluttering your chart.

Horizontal lines extend from high-volume candles marking exact High/Low or Open/Close levels. Choose between three display modes or show both simultaneously. Built-in overlap prevention filters out lines too close together, keeping charts clean while highlighting the most significant price levels where volume spiked.

⚙️ Advanced Controls

Auto-stagger system prevents overlapping labels on narrow-range candles by intelligently shifting text vertically. Display exact price levels, volume percentages (e.g., "H: 4505.25 (247%)"), and optional date stamps. Configurable threshold detection ensures labels remain readable even during consolidation periods.

Shaded areas between High/Low or Open/Close of high-volume candles create visual zones highlighting where significant institutional activity occurred. These clouds help identify future support/resistance areas, order blocks, and liquidity zones. Fully customizable transparency and colors to match your chart theme.

Separate alerts for each volume level (1, 2, 3) with distinct messages for bullish and bearish spikes. Get notified when Level 3 extreme volume hits (VERY STRONG signal), Level 2 strong activity, or Level 1 initial moves. Never miss institutional entries, breakouts, or potential reversal signals again.

Choose baseline calculation method with 1-200 period range

Show/hide lines for specific volume levels independently

Limit display to 1-100 most recent high-volume candles

Hello, World!