📊 Savvy Trader Weekend Round-Up

For Swing & Day Traders | Week of April 21, 2025

🧭 Market Outlook & FOMC Update

Federal Reserve: Fed Chair Powell noted inflation remains above 2%. No rate cuts likely until summer.

Next FOMC Meeting: May 6–7, 2025

Next FOMC Meeting: May 6–7, 2025

Tariffs: New 10% base tariffs on imports (higher for China). China responded with retaliatory tariffs. Expect volatility across commodities, industrials, and semiconductors.

📊 Sector Performance

✅ Top 3 Sectors

| Sector | Ticker | Weekly Performance |

|---|---|---|

| Energy | XLE | +2.26% |

| Real Estate | XLRE | +1.58% |

| Utilities | XLU | +1.03% |

❌ Bottom 3 Sectors

| Sector | Ticker | Weekly Performance |

|---|---|---|

| Health Care | XLV | -0.62% |

| Technology | XLK | -0.55% |

| Communication Services | XLC | +0.65% |

Rotation: Money is flowing into defensive sectors (Utilities, Real Estate). Weakness continues in high-beta Tech and Health Care.

📅 Earnings Calendar (Week of April 21)

| Ticker | Company | Sector | Report Date |

|---|---|---|---|

| TSLA | Tesla Inc. | Consumer Discretionary | Apr 23 (Tue) |

| GOOGL | Alphabet Inc. | Communication Services | Apr 23 (Tue) |

| INTC | Intel Corp. | Technology | Apr 25 (Thu) |

| WAL | Western Alliance | Financials | Apr 23 (Tue) |

| ZION | Zions Bancorp | Financials | Apr 23 (Tue) |

| AGNC | AGNC Investment | Real Estate | Apr 24 (Wed) |

Sector Focus: Tech and Financials dominate this week’s earnings lineup.

🧾 Notable Analyst Ratings

- Downgrade: Citigroup downgraded U.S. equities to neutral due to tariff risks and small-cap recession fears.

- Upgrade Watch: Check Finviz Analyst Screener for daily upgrade candidates.

📌 Key Economic Events This Week

| Date | Event | Impact |

|---|---|---|

| Apr 23 (Tue) | Flash PMI (US, EU) | High – market volatility expected |

| Apr 25 (Thu) | US Core Durable Goods Orders | Medium – impacts industrials |

| Apr 26 (Fri) | U. of Michigan Inflation Expectations | High – sentiment indicator |

📈 Quick Trade Ideas

- Bullish: Energy & Utilities holding trend — potential long setups.

- Bearish: Tech weakness post-earnings — short the pop opportunities.

- Volatility Play: High short interest stocks that beat earnings — watch for squeezes.

🗓️ Weekend Market Report

📅 April 13, 2025

📈 Market Recap (April 7–11)

- S&P 500 (SPY): +5.7%

- Nasdaq (QQQ): +7.3%

- Dow Jones (DIA): +5.0%

- Russell 2000: +1.8%

Market rallied despite early-week volatility tied to tariff announcements. Tech and Materials led the charge, while Consumer Discretionary lagged.

📊 Sector Performance

- Top Gainers: Materials (+2.97%), Energy (+2.52%), Technology (+2.02%)

- Lagging Sectors: Consumer Discretionary (+0.98%), Communication Services (+0.82%)

📉 Market Sentiment

Sentiment remains cautious. Yields are rising, consumer sentiment is falling, and traders are watching for earnings volatility and economic shocks.

🔮 Fed Watch

- Traders expect rate cuts later this year.

- FOMC policy path closely monitored via CME FedWatch Tool.

📅 Economic Events Next Week

- Apr 14: NAHB Housing Market Index

- Apr 15: Empire State Manufacturing Index

- Apr 16: March Retail Sales

- Apr 17: Housing Starts, Building Permits

- Apr 18: MARKETS CLOSED (Good Friday)

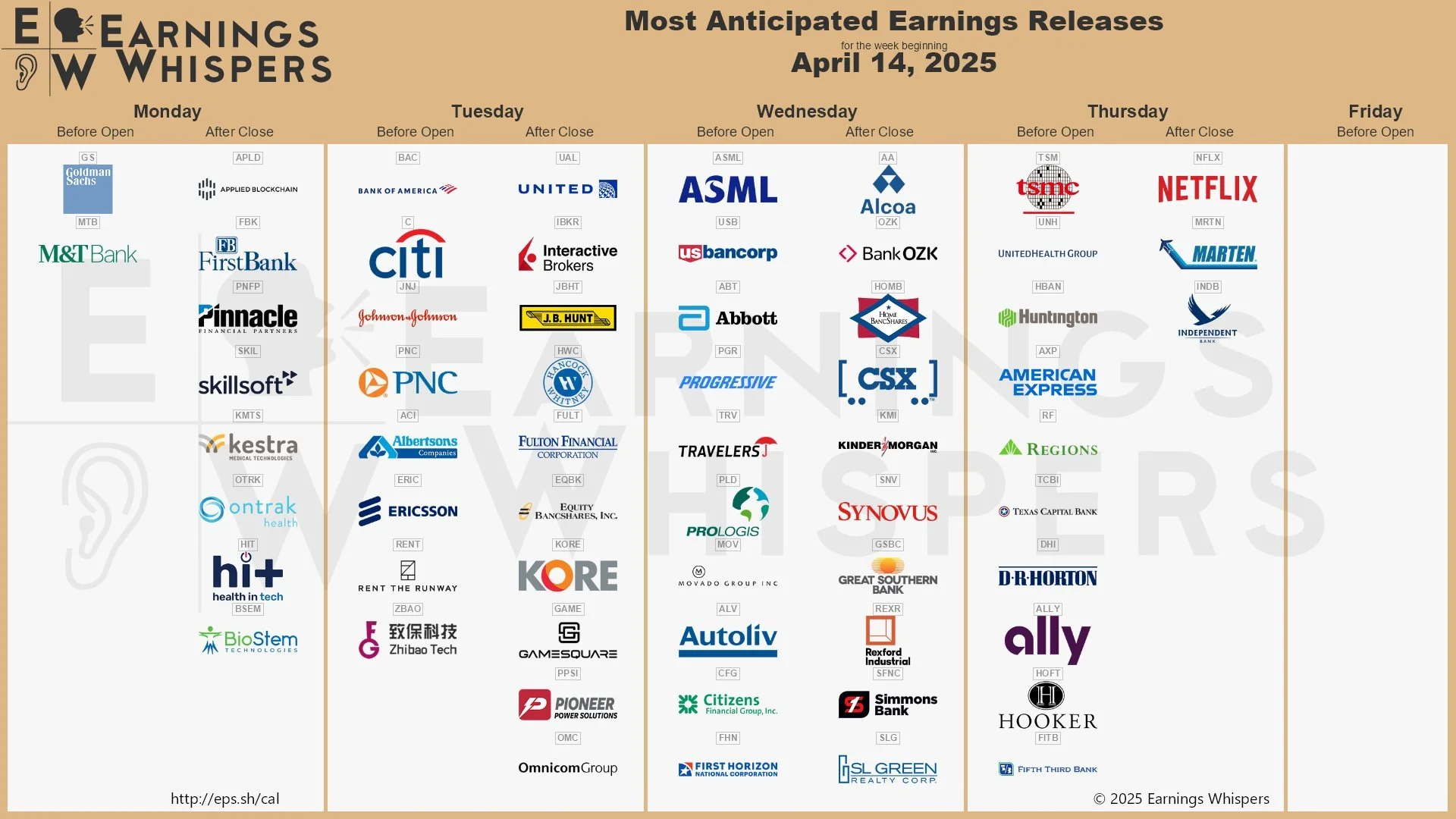

💼 Major Earnings Reports

- Apr 14: Goldman Sachs (GS)

- Apr 15: Bank of America (BAC), Citigroup (C)

- Apr 17: Netflix (NFLX), Taiwan Semi (TSM), UnitedHealth (UNH)

📌 Trading Implications

- 💥 Volatility expected — use tight risk controls.

- 📊 Watch tech & banks — catalysts from earnings and guidance.

- 🏗️ Retail & housing data may impact sentiment midweek.

🛠️ Tools to Watch

- Investing.com — Earnings Calendar & Economic Indicators

- ForexFactory — Global Calendar & Volatility News

- Unusual Whales — Unusual Options Flow & Sentiment

- X (formerly Twitter) Posts — Real-time updates